- African Fundraising Deal of the Year

- African Solar Deal of the Year to Akuo Kita, Mali

- African Power Deal of the Year, Nachtigal, Cameroon

“We were particularly impressed by the participation of Allianz, a major European institutional investor, and the significant impact the fundraising could have on African infrastructure,” Jon Whiteaker, Editor, IJGlobal

IJGlobal, the specialist global infrastructure market intelligence organisation, has awarded projects supported by PIDG company The Emerging Africa Infrastructure Fund (EAIF) three prizes at its 2019 awards event. The London prize-giving, on 21st March, saw EAIF win African Fundraising Deal of the Year, African Solar Deal of the Year and African Power Deal of the Year.

In 2018, EAIF raised US$385 million to continue its core strategy of mobilising public and private finance for investment in private sector infrastructure projects across Africa, often in fragile states.

The fundraising met all of IJGlobal’s criteria to qualify for and win the African Deal of the Year award; it moved the market forward, featured significant complexity, overcame many obstacles, created opportunities for new market participants and can deliver positive social and economic impact.

The lending group for the US$385 million includes long-standing lenders KFW, the German development bank, FMO, the Dutch development finance institution, and Standard Chartered Bank. The African Development Bank (AfDB) returned as a lender. For the first time, EAIF attracted a large commercial institutional investor in global insurer Allianz. EAIF’s equity is provided by the governments of the United Kingdom, The Netherlands, Switzerland and Sweden.

Jon Whiteaker, Editor of IJGlobal says, “We were particularly impressed by the participation of Allianz, a major European institutional investor, and the significant impact the fundraising can have on African infrastructure.”

EAIF, was joint Mandated Lead Arranger of the debt finance on the 50MW Akuo Kita Solar project in Mali. It won African Solar Deal of the Year. One of the largest solar plants in West Africa, it will provide power to the equivalent of 91,000 homes.

African Power Deal of the year was awarded to the Nachtigal Hydro Power Company’s 420MW run-of the-river project on the Sagana River in Cameroon. EAIF has loaned €50 million to the project, which will boost Cameroon’s base load electricity supply by up to 30%.

Since its foundation in 2002, EAIF has invested around US$1.3billion, which has been instrumental in attracting over US$10.9 billion of private capital investment to over 70 projects in some 22 sub-Saharan countries. The EAIF portfolio is mapped against the UN’s Sustainable Development Goals, ensuring that projects can directly, demonstrably and quantifiably contribute to positive impact across the continent.

EAIF is part of the Private Infrastructure Development Group (PIDG). PIDG blends public and private finance to reduce investment risk, promote economic development and combat poverty in low-income countries and fragile states. Allianz’s investment in EAIF was a landmark event in the drive by PIDG companies to attract greater levels of funding from institutional and commercial sources.

EAIF is managed by Investec Asset Management, which led the fundraising.

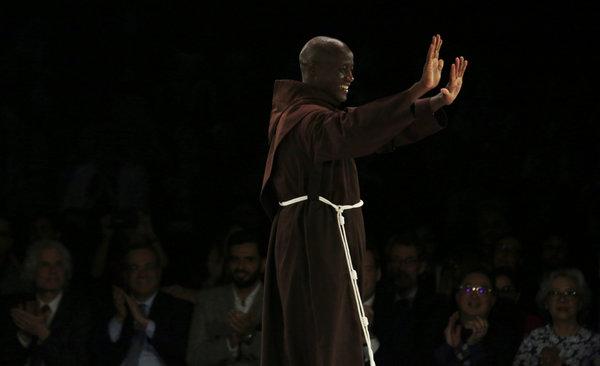

PIDG CEO Philippe Valahu says,

“The awards from IJGlobal recognise EAIF’s leadership role in driving long-term foreign currency lending in Africa. Above all, it marks out PIDG and its companies as a partner of choice for private sector institutions with a growing appetite for investing in infrastructure.”

For further information: