Foreign direct investment (FDI) represents the inflow of capital that enters a country from other parties outside of the recipient specifically for stimulating development in such recipient countries.

Oftentimes, it serves as an alternative to other sources of funding for governments to engage in value addition for their citizens.

Across Africa, criteria like ease of doing business and enabling government policies, among others, have served as incentives that help attract FDIs into various sectors of the economy, even as Africa’s FDI landscape has continued to experience transformations as a result of several ongoing economic measures by countries to spur growth as well as ensure even and sustainable development.

Given the diversity of African economies, this piece will shed light on the foreign investment dynamics that are shaping the investment scene on the continent.

Africa is repositioning itself on all fronts and is setting itself on the path of development, which has seen it become an attractive investment destination of choice for FDIs.

The continent’s FDI landscape is an evolving one that constantly experiences change. It is characterised by a diverse set of investors, a variety of sectors, and an increasing focus on sustainable development.

Countries on the continent have attracted FDI from a range of sources, including traditional investors such as the EU, the US, the UK, and China, as well as emerging investors like India and the Gulf countries.

A variety of sectors, including natural resources, infrastructure, and services, have attracted significant FDI flows. In recent years, there has been an increasing focus on sustainable development, with investors looking to create positive social and environmental impacts in Africa.

As such, African governments are opening their economies to make sure all sectors are made more attractive for the opportunities abounding to be explored.

Having been considered strategic for growth, in addition to opening up their economies, African countries, like many other developing nations, according to the United Nations World Investment Report 2023, are engaging in various policy reforms to attract foreign investors, which in turn are yielding positive results gradually.

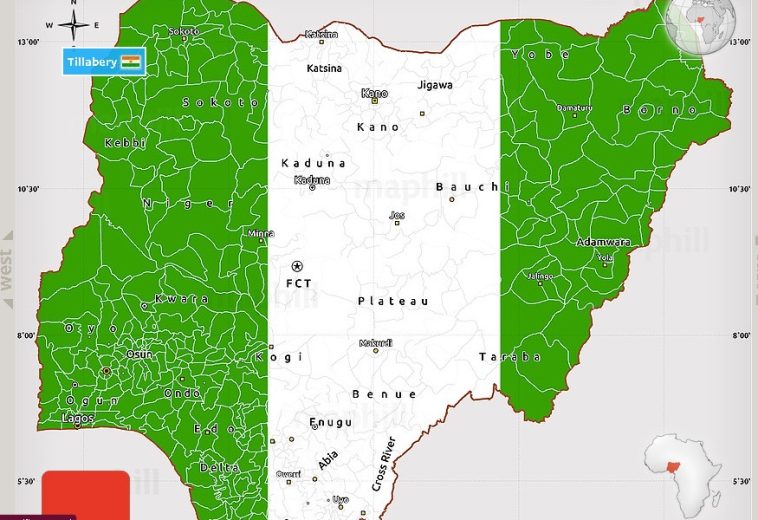

Giving specific examples, Nigeria comes in handy as a good example of a country with a changing FDI landscape. Over the past few decades, Nigeria’s major resource that attracted investors’ attention was the oil and gas sector, which also attracted a significant amount of FDI for Nigeria.

However, in recent years, efforts have been on the rise to diversify the economy to attract investment in other sectors like agriculture, manufacturing, and technology. Aside from oil and gas, the main sectors for FDI inflows into Nigeria include telecommunications, financial services, agriculture, education, and industrial machinery.

This diversity has led to a marginal increase in FDI for Nigeria over time, although the country recorded its lowest FDI in nine years in the first quarter of 2023, Q1 of 2023 when it recorded $47.6 million, but rebounded again in the second quarter (Q2) of 2023 as FDI increased to $86.03 million.

The decline represents part of the dynamics that affect FDI flows to any country. In Nigeria’s case, it represents foreign investors’ confidence in the economy, which could be attributed to the state of the economy and the political atmosphere in the build-up to and aftermath of Nigeria’s 2023 general elections.

Another country with a dynamic FDI landscape in Africa is Kenya, which has been identified as one of the top recipients of FDI in East Africa in recent years due to several factors, including its status as a regional hub for trade and investment, its strategic location, and its strong growth potential.

The investment environment in Kenya is also conducive due to full liberalisation, which allows foreign investors to invest up to 100% ownership, except in sectors like securities, insurance, power, lighting, and any other sector that the government may deem fit to limit its foreign investors.

Kenya has attracted a significant amount of FDI in sectors such as manufacturing, agriculture, energy, and infrastructure, thereby contributing to the nation’s Gross Domestic Product (GDP, As of 2022, Kenya’s FDI recorded a growth equal to 0.3% of the country’s nominal GDP but lower compared to the 0.4% of 2021.

Let’s move on to Rwanda, which has also seen a significant increase in FDI flows in recent years, driven by its strong economic growth and political stability. The Rwandan government has implemented several reforms to improve the business climate, including simplifying the procedures for starting a business and implementing a one-stop shop for investors.

As a result of these, a variety of sectors, including tourism, mining, and infrastructure, have continued to attract FDI, which is stimulating growth. For instance, in 2022, foreign direct investment in Rwanda was $0.40 billion, an 88.11% increase from 2021, which recorded $0.21 billion, also a 38.84% increase from 2020.

These figures are reflections of fluctuations brought about by the changing dynamics of the business climate in African countries at different points in time, thus a pointer to the fact that several decisions, actions, and inactions taken by governments and their people can affect foreign investments both positively and otherwise.

Over time, factors such as low growth, political and macroeconomic instability, weak infrastructure, poor governance, and poor regulatory environments have been identified as responsible for the poor FDI record of the region.

Looking at it from another dimension, FDI inflows into Africa vary from country to country as a result of what each country has to offer. According to UNCTAD’s 2023 report, as of 2022, on average, northern Africa came in as the highest recipient of FDI in Africa due to investments in oil exploration in most of the countries in the subregion as well as the privatisation policies embarked upon.

After that was West Africa, followed by Central Africa, then East and Southern Africa.

Just as mentioned earlier, Africa is still growing and, as such, has the opportunity to get it right to attract more FDIs. It only needs to put in place the right policies, ensure its political atmosphere is devoid of tensions that could lead to uncertainties and insecurity capable of scaring away investors as well, and ensure that bureaucracies are done away with. When all these are done, no doubt the continent’s FDI will increase and the continent will be better for it.