One of the most important benefits of fintech in East Africa has been its role in driving financial inclusion. Traditional banks struggled to reach large segments of the population, particularly in rural areas, where infrastructure and access were limited. Mobile financial services provide a solution, offering a convenient and cost-effective way for people to access and manage their finances. As a result, formal financial inclusion rates have soared, with a substantial portion of the population now utilizing mobile financial services rather than traditional banking.

Fintech has had a profound impact on rural financial inclusion. Previously underserved rural communities now have access to a wide range of financial services, empowering them to participate more fully in the economy. Mobile financial platforms have enabled farmers to access credit, save money, and even purchase insurance, fostering economic growth and resilience in these areas.

The benefits of fintech extend beyond traditional financial services, reaching into sectors such as healthcare, education, and retail. Mobile money has facilitated the payment of medical bills, the provision of insurance services, and even the payment of school fees through platforms like SchoolPay. In the retail sector, online platforms like Jumia have transformed the way people shop, offering convenience and accessibility to consumers across the region.

Financial technology has been instrumental in capital market development, with innovations allowing individuals to invest in government securities through mobile platforms. These initiatives not only promote savings and investment among the general population but also provide governments with a new avenue for financing infrastructure projects.

However, despite the tremendous potential of fintech, there are still challenges to overcome. Challenges that are primarily centered around cybersecurity and data privacy concerns. These issues are exacerbated by a decrease in investment, regulatory hurdles, competition from traditional banks, and a lack of consumer trust. Macroeconomic factors such as inflation and reduced consumer spending pose threats to Fintech companies’ sustainability. The sector must navigate the complexities of currency fluctuations and the difficulty of scaling operations across the diverse African continent.

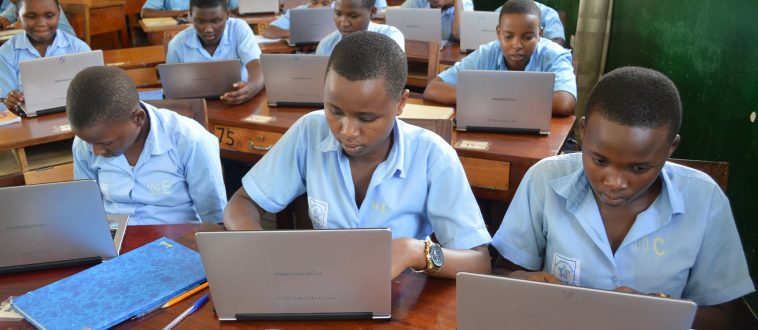

One such challenge is digital literacy, particularly in rural areas with limited access to technology and education. There are initiatives aimed at addressing this gap by equipping young Africans with digital skills, but more investment and support are needed to ensure widespread digital literacy.

READ ALSO: The Growing Risk of Children Exploitation in Niger

Another challenge is the need for more local financing for fintech innovations. While external investment has flowed into the sector, there is a pressing need for local financing to drive innovation and ensure that products and services are tailored to the region’s needs. Organizations like the East African Development Bank are working by collaborating with local financial institutions to develop affordable financing solutions for SMEs and agricultural projects.

Despite these challenges, Fintechs remain crucial for financial inclusion and innovation in Africa. A considerable portion of the population in East Africa remains financially excluded, lacking access to basic banking services and credit. Fintech solutions have the potential to bridge this gap by providing affordable, accessible, and user-friendly financial services to underserved communities. Fintech companies can reach individuals previously overlooked by traditional banks, thereby expanding financial inclusion and empowering marginalized groups, including women, smallholder farmers, and rural entrepreneurs.