In recognition of the efforts and commitment to pursuing economic reforms in the country, the Governor of the Bank of South Sudan (BoSS), Hon. Johnny Ohisa Damian was recently conferred with the instruments of honour as co-winner of the Africa Central Bank Governor of the Year Award. At the just-concluded 13th African Business Leadership Awards (ABLA) presentation ceremony, organised by the African Leadership Magazine.

The ABLA presentation ceremony was a key highlight of the 8th ALM Africa Summit, which took place on Tuesday, 11 July 2023 at The Dorchester Hotel, London – United Kingdom. With the theme- New Opportunities for African Investments, Partnerships, and Collaborations.

Hon. Johnny Ohisa Damian who was earlier recognised as one of the Top 25 African Finance Leaders 2023, by the African Leadership Magazine, has served in various capacities within the Central Bank of South Sudan. From 2019 to 2021, notably as the Director General for Currency and Banking Operations and as the first Deputy Governor and acting Governor. Before he was appointed Governor of the Central Bank. Prior to joining the Bank of South Sudan, he was the Deputy Managing Director and later Managing Director (MD) of the International Commercial Bank (ICB-SS). The Governor also worked in various capacities at the United States Agency for International Development (USAID) in Sudan, Kenya, and the Democratic Republic of Congo (DRC).

As Governor of the Bank of South Sudan, Hon. Damian has engendered reforms and coordinated sound monetary policies. All of these are aimed at inspiring confidence in the country’s banking sector. Engendering a strong and efficient financial sector. As well as promoting economic stability and financial inclusivity for the benefit of South Sudanese people. The Governor has also ensured the formulation and implementation of policies and programs. In order to spur sustainable economic growth across all sectors and segments of society.

In an exclusive interview with the African Leadership Magazine, the Governor noted some of the reforms in the country’s banking and financial services sector. Including the implementation of global best practices in risk-based supervision as a means of safeguarding integrity, prosperity and trust in the nation’s nascent financial and banking system. The impact of the risk-based supervision enabled the Bank of South Sudan to revoke the licenses of two (2) local banks for failing to meet the threshold and dismissed the entire Board of Directors and Managing Director of South Sudan’s largest local bank due to issues related to corporate governance.

As part of the reform agenda, the BoSS played a pivotal role in the establishment of the Financial Intelligent Unit (FIU). An independent body that will be able to provide oversight on the overall financial system. In addition, the bank also took measures in profiling critically undercapitalized banks, giving them the ultimatum to merge, divest shareholders, voluntarily liquidate or face force liquidation, as well as licensed strong banks to fill the gap. These measures have led to a sharp increase in private sector credit, with a positive impact on South Sudan’s economy.

Furthermore, as dollarization has been a serious policy concern for the Bank of South Sudan (BoSS) since independence in 2011, the Bank of South Sudan issued a circular to reinforce the use of the South Sudanese Pound as legal tender in all transactions within the jurisdiction of the country. To curb the dollarization of the economy which is also hiking of the interest rate by the Federal Reserve Bank.

In the agricultural sector which is believed to employ about 80 percent of the labour of the population, the Bank of South Sudan’s monetary and banking policies encourage commercial banks to extend credit to the private sector. Including agriculture, as the banks have been directed to increase Private sector credit (PSC) to SMEs by 40 for the year 2023. These policies, coupled with the liberalization of the exchange rate have had a significant impact on the increase of PSC credit. In that commercial banks’ loans portfolio used to be around 8 percent of total deposits. But is more than double (i.e., 18 %) during the first quarter of 2023.

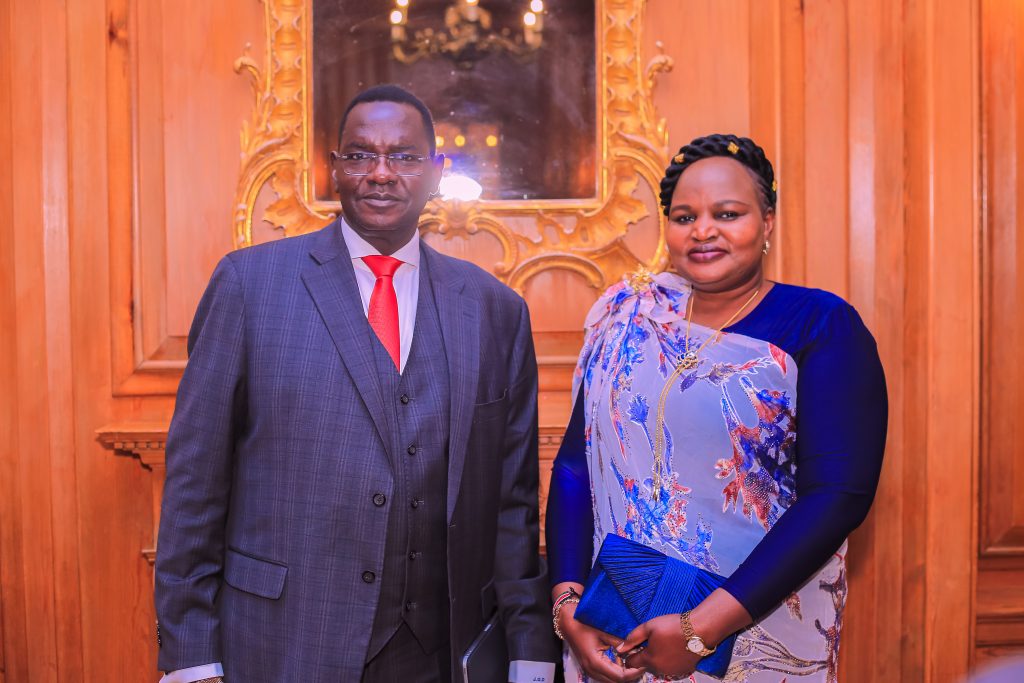

In his acceptance remarks upon receiving the co-winner of the Africa Central Bank Governor of the Year Award, Hon. Damian said “The award recognition is something that has taken us by surprise, not only me but also the whole country. This award comes right after we celebrated our independence anniversary. What could be more important than to be recognized by the prestigious organization ‘The African Leadership Organization!’. To me, this is a very big achievement for the country given the fact that I have just been there a year as a governor. “The minister of Finance is also in office for little over a year.”

He added that “we have had the support of our President and the Government to ensure that we make the country ready for investment. I thank the African Leadership Organization for recognizing us. This is an achievement that we did as Bank of South Sudan and together with the Minister of Finance, we have worked closely to ensure the reforms are done.”

The African Business Leadership Awards (ABLA) was organized by the African Leadership Organization. Publishers of the African Leadership Magazine UK, attracting high-level business leaders and policymakers. Including Lord Dolar Popat, a Member of the UK House of Lords and the British Prime Ministers Trade Envoy to Rwanda and Uganda. Baroness Sandy Verma, Member UK House of Lords. Hon. Renganaden Padayachy, Minister of Finance, Economic Planning and Development, Mauritius. Rindra Rabarinirinarison, Minister for Economy & Finance, Madagascar. Hon. Seedy Sk Nije, Deputy Speaker, National Assembly Of The Gambia. And Hon. Fonati Koffa, Deputy Speaker, House of Reps, Liberia.

Other guests at the event include His Royal Majesty, Ògíamẹ̀ Atúwàtse III CFR, Olu of Warri Kingdom, Nigeria. Olori Ògíamẹ̀ Atúwàtse III, Queen Consort of Warri Kingdom, Nigeria. Hon. Debele Kabeta Hursa, Commissioner, Ethiopian Customs Commission. Mrs Mukwandi Chibesakunda, CEO, Zambia National Commercial Bank (ZANACO) Plc. Mohammed Bello-Koko, Managing Director/CEO, Nigerian Ports Authority (NPA). Nokuthula Selamolela, CEO Food and Beverages Manufacturing, South Africa. And H.E. Dr. Benedito Paulo Manuel, Director General, Sociedade Mineira De Catoca Lda, Angola; amongst others.