The UK’s Trade Commissioner for Africa Emma Wade-Smith sits at the heart of a renewed effort to boost Britain’s economic footprint on the continent.

As the UK prepares to finally cut loose from the European Union on January 1st 2021, the search is on to find new trading links and Africa is a major link in this new world.

For almost fifty years, the UK has traded within the EU umbrella. Now its long-standing European trade partners are about to become its trade rivals. Whether the UK leaves the EU with a deal or not one thing is clear – the UK is about to experience a very different trading environment. And it is down to Britons like Emma Wade-Smith to make a success of this new world.

From her Johannesburg base, she is busy putting in place her stated aim to make the UK what she calls “Africa’s investment partner of choice.”

She presides over a growing number of regional offices positioned across Africa to provide market and sector knowledge for British entrepreneurs seeking to trade with their African counterparts. There were twenty-three offices at the last count.

Last month a bilateral trade deal was signed with Kenya, and now the UK is looking to replicate that in many other countries as it begins its new life as a sole trader operating outside the European Union for the first time in almost fifty years.

Meanwhile, her Department of International Trade team has set up an Africa Investors Group to drive UK investment into Africa. A deal has been signed with the ASOKO investment platform to create a virtual dealing room where African companies seeking funding can hook up with UK investors. In the past nine months, the Deal Room is estimated to have generated three-quarters of a billion pounds in new business.

Her team in Africa is already helping to run Technology hubs in South Africa, Kenya and Nigeria where young African entrepreneurs, and in particular female entrepreneurs, can build skills and get their businesses market-ready for partnerships with entrepreneurs in the UK.

These hubs link into the UK’s Tech For Growth Programme, which specialises in the FinTech ecosystem. In addition to FinTech Emma Wade-Smith is keen to encourage start-ups operating in infrastructure, renewables, health technology, online education and agribusiness. In her view, all these sectors are key areas for the future growth of African entrepreneurial talent.

At present, almost half of the UK’s Africa trade is with Morocco, Tunisia and the southern African customs union. Last year UK bilateral trade with Africa grew by 4% to £36 billion, but Emma Wade-Smith believes the UK can do much better in the future.

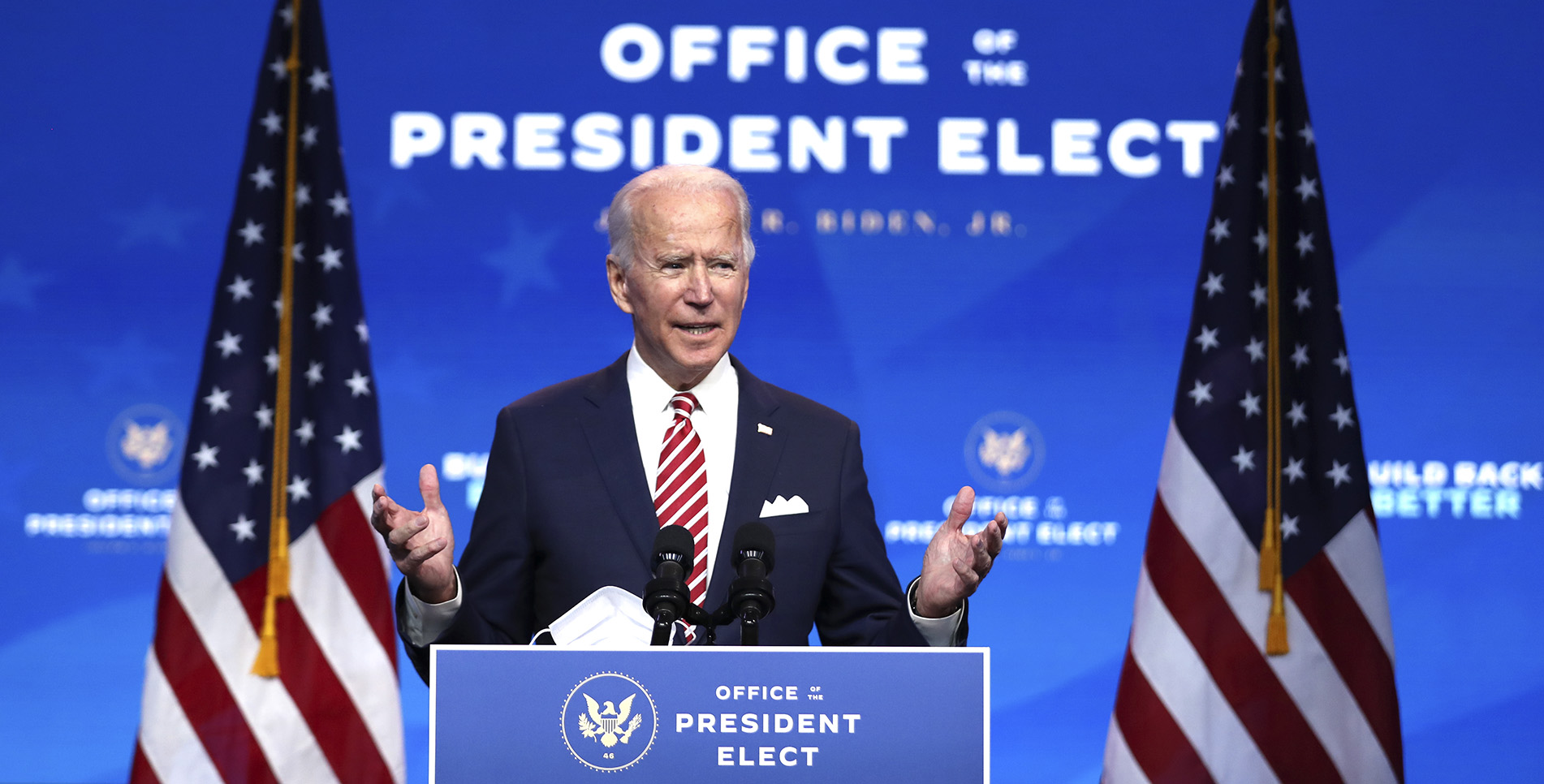

But this is no free-fire zone. You can be sure that the twenty-seven countries still in the EU, not to mention China, Russia, Iran, Turkey and the USA reinvigorated in its Africa interests by the election of Joe Biden are also sharpening up their economic muscles to tap into these African opportunities.

Currently, the UK lies in third place behind the Netherlands and France in the volume of Foreign Direct Investment stock. Netherlands invested $78 billion between 2014 and 2018, France $53 billion compared to the UK’s $49 billion.

The twenty-seven other countries who make up the European Union, including the big economies of Germany, Italy and France are now trading rivals rather than partners. From January 1st 2021 after almost five years the long goodbye that began when the UK voted by a narrow margin in a referendum to quit the EU and take its chances as a single trading nation finally becomes a reality.

From January the UK finds itself unshackled from EU regulations, ready to make its own way in the world and embrace the new “Global Britain” brand its supporters demanded. It also means setting out into those global marketplaces outside the negotiating advantages of belonging to the world’s richest single market and trading block.

And in return will those global marketplaces find the UK as an attractive partner now it is no longer a gateway into the EU single market? Already some global companies, particularly in financial services, are relocating their headquarters from London to Paris and Berlin and other European capitals.

The countdown to this UK adventure has coincided with the double whammy of Covid-19 and low commodity prices which have seen investment flows into Africa drop significantly. According to UNCTAD’s World Investment Report, 2020 FDI flows into Africa are forecast to contract between 25% and 40% this year

Even if current conditions are adverse, clearly there is great potential for growth across the continent. It is projected that a post-Covid-19 Africa will deliver opportunities to “build back better”. Already senior African leaders like former African Development Bank President Donald Kabaruka and former South African Finance Minister Trevor Manuel are hard at work charting the continent’s new economic recovery path.

Another boost to UK’s future prospects is that its transition to become a single trading nation is happening at exactly the same time that the African Continental Free Trade Agreement (AfCFTA) is being launched to create a single market of more than a billion people said to be worth around three trillion dollars a year.

Speaking at a virtual UK-Africa Investment conference in October Commissioner Wade-Smith outlined the benefits of the AfCFTA:

“We can see that bringing together a free trade area is hugely significant. It will drive industrialisation to the benefit of millions of African people.”

Her boss, the UK’s Minister for Africa James Duddridge, was equally bullish about the importance of the AfCFTA. He said at the Investment conference that the UK was keen to ramp it up and help make it a success.

Minister Duddridge pointed to the role of the UK’s publically owned impact investor group CDC and its plans to commit £2 billion into African businesses over the next two years which will double the size of its Africa portfolio. Currently, the CDC has provided equity to around 400 African companies and their 800,000 employees.

Another bright light for the UK is the growing impact of climate change. In the middle of 2021, the UK will host the delayed- COP26 Climate Change Summit, which will bring leaders from around the world to Glasgow in Scotland to agree to new protocols on combatting global warming. The UK is determined to use the Summit and the countdown to it to demonstrate its green credentials and present itself as a champion of climate change.

CDC’s Chief Executive Nick O’Donohoe urges UK investors to “embrace the huge opportunity to support the UN’s Sustainable Development Goals (SDGs):

“Investors have a real opportunity to embrace the SDGs in partnership with African countries and businesses – to fight climate change, create jobs and skills and bring about positive social and environmental change”.

There’s everything to play for and no doubt that from all the hectic activity at her Joburg HQ that the UK’s Trade Commissioner Emma Wade-Smith is well and truly up for this new scramble.